You may be wondering: “As a self-employed individual, do I have access to Employment Insurance (EI) benefits?” The answer to this is: “Yes, as long as you pay into the program.”

To obtain EI benefits as a self-employed individual, you must enroll into the EI Special Benefits Program Service Canada offers.

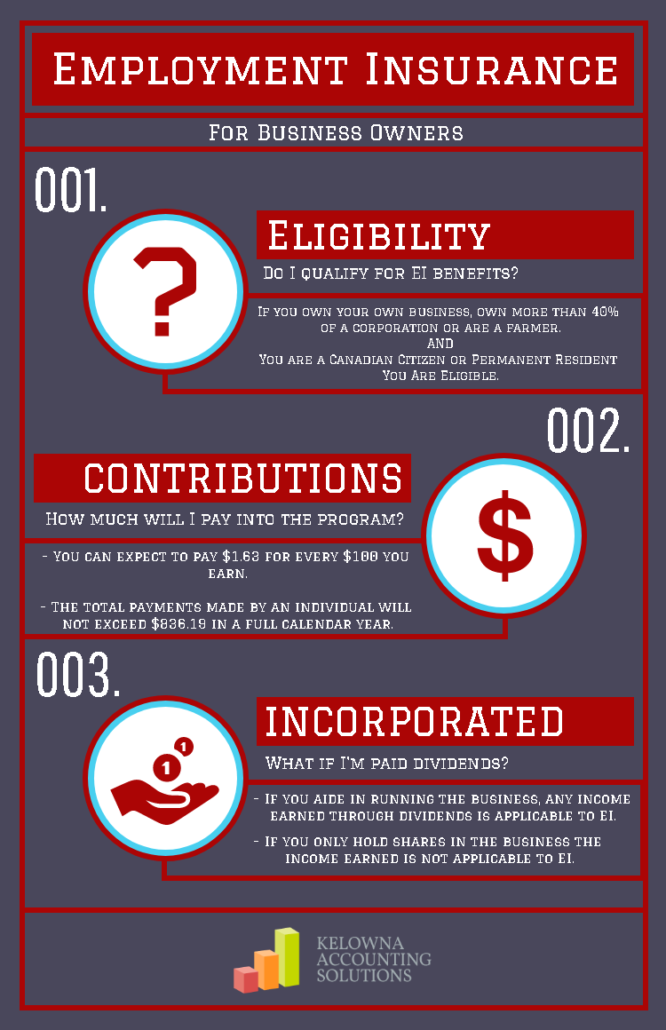

- Do you own your own business? Own more than 40% of a corporation? Are a farmer? If yes, then you are eligible to pay into the EI Special Benefits program.

- Independent contractors ( where you sign a contract to work full-time under an employer, but not as a regular employee – ie. chauffeur, hair dresser, etc. ) should utilize the regular EI program Service Canada currently offers.

- As a self-employed individual ( complete services for a client ) you are eligible for the EI Special Benefits program.

When will I be able to submit my first claim and receive premiums paid out by Service Canada?

- Premiums are available 12 months from the date you register and start contributing into the program. So, if you register and start making payments on July 1, 2017, you will be able to apply and make a claim to receive your benefits as early as July 1, 2018.

How much will my contributions be?

- You can expect to pay $1.63 for every $100 you earn.

- The total payments you will make to the program will not exceed $836.19 in a full calendar year.

Enrollment into the program is easy:

- Login or create a My Service Canada account.

- Select the tab reading: “Employment Insurance for the Self Employed”; once clicked, follow the prompts.

In addition, Service Canada outlines once an EI benefits claim is made, you are locked into the program indefinitely; meaning for the remainder of your self-employed career you will need to continue making appropriate contributions.

What if I have incorporated my business, can I expect to make EI contributions under both the salary or dividend options?

- Receiving payments from the company by salary would require you to make the appropriate contributions to Employment Insurance, as would be seen with a normal employee.

- Receiving payments by means of dividends is more complicated. Making such contributions is based on what your role is within the company.

- Because you aide in running the business, any earnings you receive through dividends will be applicable to the calculation of your EI contributions.

- Holding shares within the corporation and taking zero part in the operations of the business means any income earned through dividends will not be applicable in calculating your EI contributions.

Questions you should consider when contemplating if EI is right for you, include?

- Do you have enough savings to cover your costs if you give birth, get sick, or sustain injuries on the job?

- Are the services or products you offer competitive in the market? Will they remain competitive?

- Do you have enough earnings to sustain your costs until you find employment?